In our collective vision of the future, we aspire to live with peace of mind, knowing that our loved ones, assets, and ourselves are safeguarded against unexpected events. However, in this era of economic volatility and inflation, the prudent management of our financial resources becomes crucial. We cannot afford to gamble our hard-earned money by entrusting it to uncertain entities.

When selecting an insurance company, the evaluation process should go beyond merely understanding their product offerings and associated benefits. An assessment of their trustworthiness is equally important. Who are they? What is their track record? How do they engage with their stakeholders? What principles guide their operations? These questions are vital in determining whether an insurance provider is a suitable partner for securing our future.

Stronghold Insurance, with a legacy spanning over six decades, has consistently earned the trust of countless individuals. Their unwavering commitment to excellence in non-life insurance protection and value delivery sets them apart. Rooted in core values such as Social Responsibility, Integrity, Commitment, Customer-centricity, Competence, Compassion, and Innovation, Stronghold Insurance present themselves as a reliable ally in safeguarding what matters most to us.

With a network of over 70 branches nationwide, Stronghold Insurance demonstrates their commitment to accessibility, ensuring that even those in distant provinces and municipalities can benefit from their services. As we navigate the complexities of an uncertain future, Stronghold Insurance remains steadfast in its mission to provide security and peace of mind to all who choose to trust them.

Over the years, Stronghold Insurance has established a reputable presence in the insurance industry as a reliable and comprehensive non-life insurance company. Their diverse range of insurance coverages includes:

Motor Car Insurance: Providing coverage for private cars, commercial vehicles, motor trade, and motorcycle policies.

Fire Insurance: Offering protection against loss or damage caused by earthquakes, typhoons, floods, and extended coverage.

Marine Insurance: Safeguarding your cargo and vessels from sea-related perils and other contingencies.

Property Floater Insurance: Covering fixed or movable heavy equipment such as cranes, pay loaders, cargo handling machinery, backhoes, graders, forklifts, bulldozers, and generator sets.

Suretyship: Addressing surety or bonding requirements for private or government entities, including individuals, single proprietors, corporations, non-government organizations, and cooperatives.

Comprehensive General Liability Insurance: Offering basic premises operations coverage and protection against specific risks like elevator hazards, independent contractor hazards, product hazards, and contractual risks.

Contractor’s All Risk Insurance: Providing insurance protection to builders and contractors working on projects such as residential condominiums, offices, schools, hospitals, theaters, factories, power plants, roads, bridges, piers, flood control structures, irrigation systems, dams, and water supply and drainage facilities.

OFW Insurance: Extending both non-life and life insurance coverage to our migrant workers.

Microinsurance: Tailored and affordable insurance designed to protect against perils such as accidental death, fire, lightning, earthquakes, typhoons, floods, and other natural convulsions.

Personal Accident Insurance: Coverage includes accidental death, permanent disablement, temporary total or partial disablement, and dismemberment. Additionally, there is an option to include coverage for unprovoked murder and assault.

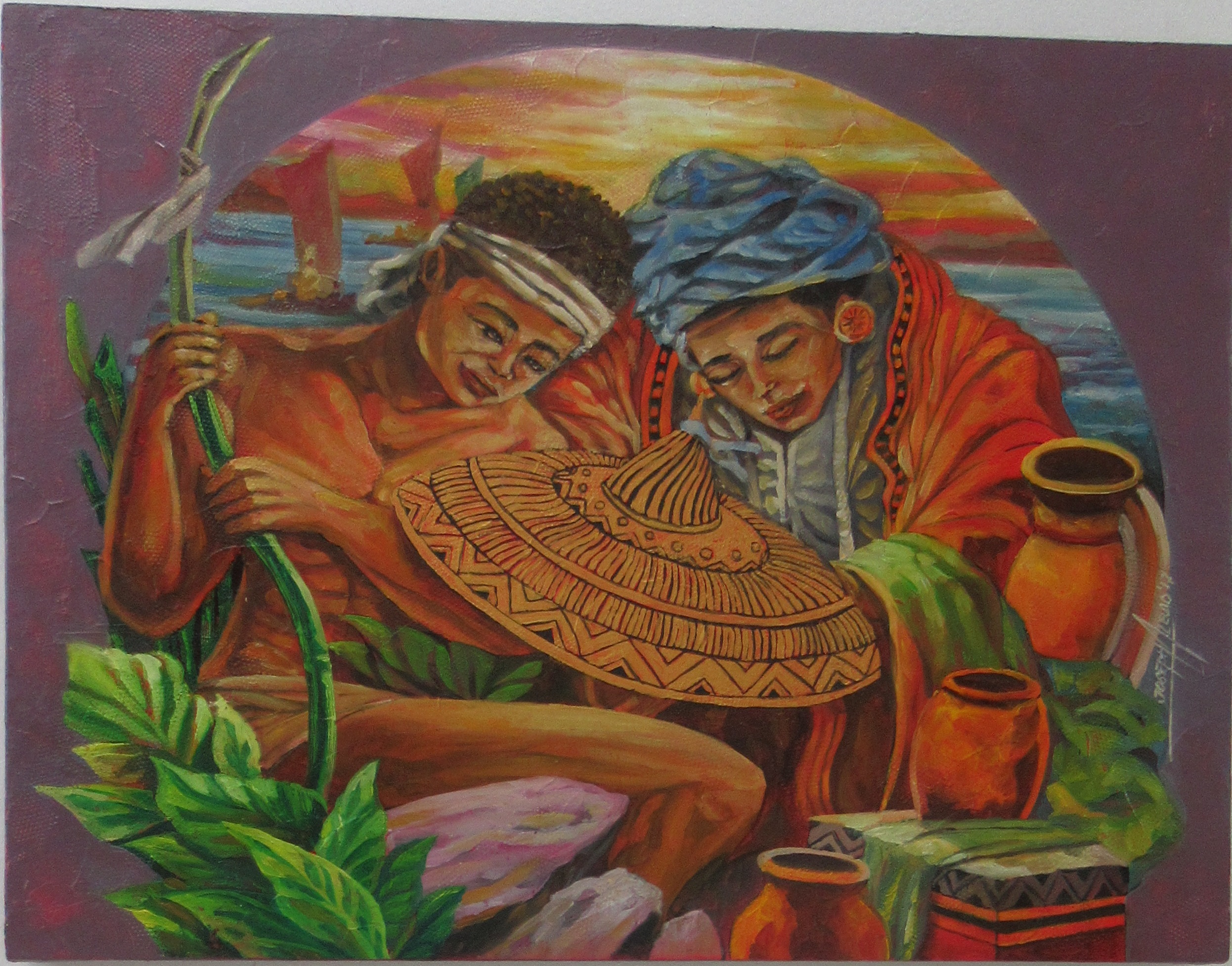

Stronghold Insurance is committed to delivering exceptional service to its customers. As part of their ongoing commitment to innovation, the Stronghold Insurance Company, Incorporated – Southern Luzon Corporate Center recently introduced the ‘Ka Barako Card.’ This product offers personal accident insurance with natural death coverage, valid for one year. Clients can select from four plan options: Robusta (up to P50,000 coverage), Arabica (up to P100,000 coverage), Excelsa (up to P200,000 coverage), and Marino (up to P200,000 coverage).

Prior to entrusting our financial resources, it is imperative that we gain a comprehensive understanding of all pertinent aspects and have all inquiries addressed. Aligned with Stronghold Insurance’s commitment to providing dependable risk coverage and unlimited capacities to their clients, they diligently ensure the delivery of excellent and efficient personalized service by their highly trained and technically adept professional underwriters.

Given the inherent unpredictability of life, exemplary customer service and expeditious claims processing are as important alongside the tangible benefits derived from our chosen insurance coverage. Stronghold Insurance prioritizes the assurance of robust protection for their stakeholders, meticulously attending to their clients’ needs. They pledge an insurance activation process of less than five minutes and a claims processing timeline ranging from 10 to 20 days.

Stronghold Insurance, with a vision extending to 2030, aspires to emerge as the leading non-life insurance provider in the country. Presently, they focus on delivering exceptional service to our esteemed clients. Their service standard is characterized by technical proficiency, streamlined processes, and cutting-edge technology, all aimed at ensuring swift and high-quality service. They uphold the highest standards of professionalism and integrity in every interaction.

As we collectively strive for a future marked by financial security and peace of mind, it becomes crucial to align with a partner who shares our commitment to safeguarding dreams. After all, who would not desire protection and assurance? If you are prepared to secure your future or seek further information about Stronghold Insurance, you can reach out to them through the contact details provided below.

Phone: (043) 757 3129, (043) 756 2590, 0920 981 4945

Email: [email protected]

Facebook: Stronghold Insurance Co., Inc. – Southern Luzon Corporate Center

Address: Lot13A Stronghold Building, Ayala Highway, Brgy. Mataas na Lupa, Lipa City